Photo: Aden Port (AFP)

Last updated on: 24-05-2022 at 9 AM Aden Time

Ahmed Bahakim (South24)

Aden has long served as one of the main economic hubs in the southern Arabian Peninsula, given its strategic location. During the British colonial period, Aden gained strategic importance as one of the busiest refueling stations in the world, a global transit point, and a major regional transportation hub. Aden became a significant hub of coffee and salt manufacturing in the early twentieth century. Furthermore, fishing, potash production, and agriculture were all well-represented and regarded as important sources of income. Aden's economy is distinct from that of the rest of the country in various respects. The steady improvement of physical infrastructure and services were key contributors in the establishment of business and trade as a former British colony and later capital of the PDRY. As a result, the emergence of a powerful and large middle class was aided. Political parties, labor groups, and autonomous voluntary associations sprang out as a result of this portion of society.

After 1990, the AFZ has grown in importance as Yemen's economic and commercial capital. The GoY and foreign donors made significant investments to expand port and airport facilities, as well as the overall infrastructure, which had been damaged by the war against South in 1994. The port facilities, which are the backbone of Aden's economy, got the majority of these upgrades. Aden's most prospective development area is the marine sector. The ACT debuted in March 1999, complementing the existing industrial complexes based on oil refineries, which have been in operation since 1954. The waterway was dredged to a depth of 15 meters to accommodate intermodal freight transport ships. The port, which is centered on the Al-Mualla wharves, can accommodate about 5.5 million tons per year. The ACT, Al-Mualla Multipurpose and Container Terminal, the Oil Harbor at Little Aden, the Aden Gulf Terminal and Passenger Terminal, as well as bunkering and anchoring spaces at the outer harbor, help compensate the Aden Gulf Terminal and Passenger Terminal. Between 2000 and 2004, this resulted in a 28-fold rise in the volume of transshipped goods [1].

Aden has outpaced other Yemeni cities in terms of employment creation before to the crisis. Aden's proportion of three important economic activities, mining and quarrying, transportation and storage, and real estate, were much greater than the national average, followed by fishing and manufacturing, although accounting for only 3.6 percent of national employment. However, while it has high labor force participation rates above the national average of 36%, it also has comparatively high unemployment rates approximately 13% [2].

Aden's Industry

The oil refinery in Little Aden, the light industry at Al Durain, and the AFZ are the primary industrial districts in Aden. Expansion and infrastructure improvements carried out under the auspices of the World Bank's Port Cities Development Program, which began in July 2002, aimed to increase the number of light industrial complexes at Al Durain to 165, increase the annual capacity of the oil refinery to around 150 million metric tons, and turn the Free Zone into a global trade hub. In addition, Aden has eleven saltworks that processed, refined, and packaged 150,000 metric tons of salt per year until recently. Aden's economy included manufacturing, chemicals, and light industry, as well as wood manufacture, plastic footwear, paint, food, beverage, and tobacco items. Between 1998 and 2002, these two factors dominated industrial production, although they have subsequently diminished [3].

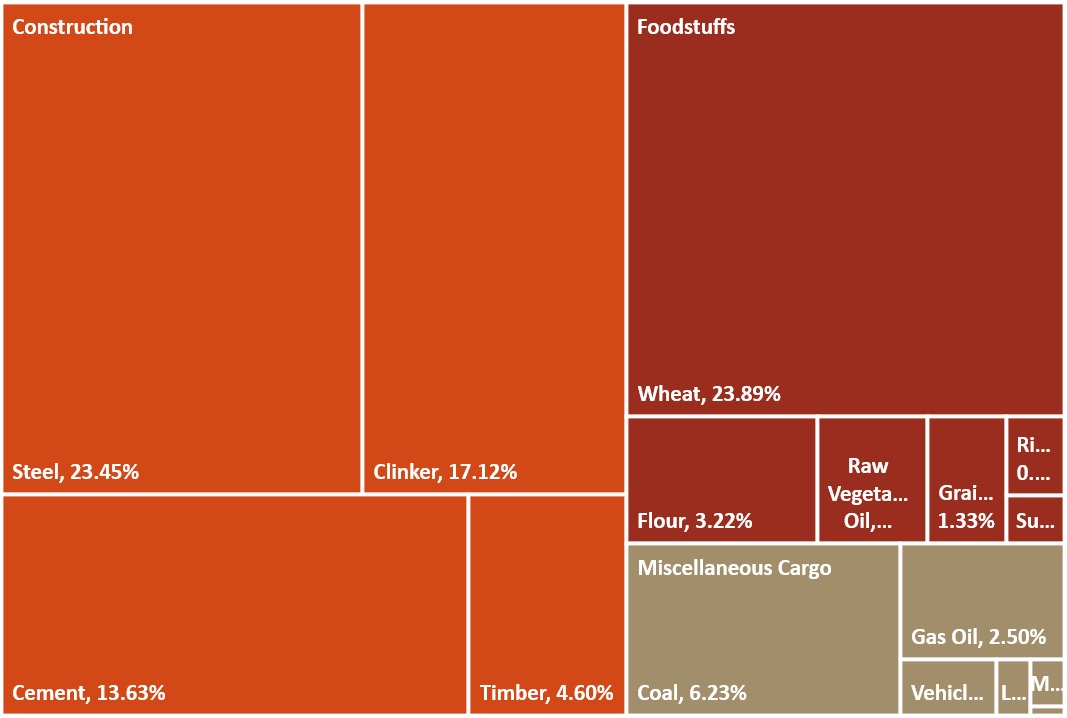

The conflict's escalation in 2015 resulted in a severe drop-in business activity. Due to the virtual suspension of all connected activity and the departure of foreign oil firms, crude petroleum output fell by 80%. The drop in Liquified Natural Gas (LNG) output that accompanied it increased the decline to 84.5 percent. This resulted in a 76 percent drop in the value of the national oil industry, resulting in a $3.6 billion income loss for the country. In June 2015, refinery activity and exports came to a standstill, affecting workers' employment and lives. Due to the halt in combat frontlines, national output has gradually increased since then, with crude oil and gold accounting for 41% and 32% of total national exports in 2017. Fruits and vegetables are next, followed by scrap metal. However, according to Aden Port data, exports of solely wheat bran and salt were 15,025 tons in 2015, with about comparable quantities in 2016 and 2017, but no figures available for 2018. Imports, on the other hand, increased to over 4.4 million tons in 2018 from just over 800,000 tons in 2015. Food and building materials outperformed all other commodities.

Total tonnage unloaded in the first three months of 2019 has already outstripped total tonnage unloaded in the same period of 2018 by 8% for foodstuffs and 33% for building materials, according to figures released by the Port of Aden officials. The new concentration on dry cargo contrasts with the pre-conflict reliance on oil. Furthermore, the disproportionate percentage of construction and food imports shows not just the country's declining industrial production, but also the severity of Yemen's food poverty.

Aden's Energy

The energy sector has been severely impacted by the conflict. Oil income accounted for about 75% of government revenue and 90% of export revenues prior to the conflict. Nonetheless, due to deteriorating security, all production in the national oil and natural gas fields was halted, and all foreign corporations working in Yemen were forced to leave [4]. As a result, output dropped dramatically. Yemen's petroleum and other liquids output dropped from 125,000 barrels per day (bbl/d) before the crisis in 2014 to a meager 16,000 bbl/d in 2018. Natural gas prices dropped from 328 billion cubic feet (Bcf) in 2014 to 17 Bcf in 2017.Furthermore, once the nation was divided into two halves, Sanaa and Aden, the former assumed control of the city and the Ras Issa oil port on the Red Sea coast, while the latter acquired control of the oil fields in Shabwa and Hadramout [5].

The Masila Basin in East Shabwa has 80 percent of Yemen's confirmed total oil reserves. In the summer of 2016, output increased to over 50,000 barrels per day, and some petroleum was transferred to China, Thailand, and Italy in the fall [6]. These levels, however, did not imply a return to pre-conflict levels of activities. Although a 2010 forecast by the United States Agency for International Development (USAID) that Yemen's oil reserves would be depleted by 2010 proved to be premature, there is little chance that meaningful quantities remain. Despite this, Yemeni officials have repeatedly said that output will be increased. For example, Safer, an IRG-owned oil business, stated publicly in October 2019 that it expects pipeline flow to increase to 15,000 bbl/d from the existing 5,000 bbl/d. The Austrian OMV, which operates in Shabwa's Haban field, is Yemen's lone foreign business as of 2018 [7].

Aden's Logistics

The first formal port in Aden, which comprised of warehouses and a customs station, was erected in the Craiter neighborhood. As commerce grew, activity shifted to Al Mualla's main harbor, which was more protected and gave greater prospects for growth. By 2002, the port has received roughly 850 container, 650 tanker, and 400 general and bulk cargo boats. The increased maritime volume mirrored the port's desire to become a significant transshipping hub, as well as a storage and re-export center in the region. Outside funding and relationships were required to achieve this aim. The port of Aden was taken over by Dubai Ports World (DPW), a public UAE enterprise, in 2008. However, the investments did not materialize, and the DPW achieved nothing to reinvigorate the port in the end. GoY ended its contract with the DPW in 2012 and took direct management of the port's facilities. The Chinese government supported a $507 million project to deepen and enlarge the ACT, which was signed between China Harbor Engineering Company Ltd. and Yemen Gulf of Aden Ports Corporation in 2013 [9].

Prior to the conflict, oil made up the majority of the cargo loaded and unloaded in Aden, accounting for 95 percent and 68 percent of total tonnage, respectively. The amount of non-oil dry cargo was insignificant. This mismatch resulted in trade imbalances and gaps. The port facilities in Aden have been constantly active during the crisis, according to government data. When the violence reached Aden between March and July 2015, shipping trade came to a standstill, but by September of same year, everything was back to normal. The overall freight tonnage processed via Aden increased by 1.7 percent at the end of 2016 [9]. However, in the following years, the percentage rise over 2015 increased by 23 percent in 2017 and 42 percent in 2018. Until April 2019, freight volume by Gross Registered Tonnage (GRT) was 11.5 percent higher than the same time in 2018. If the current trends continue, and barring any big political upheavals, FY2019 may likely be another record year for freight volume. The statistics are constantly rising, and FY2020 may possibly be another record year for freight volume. Due to its unique strategic location in Yemen, Aden's role as a temporary capital and a free trade zone is reflected in the percentage gains.

Aden's Fisheries

Fisheries were under the Ministry of Agriculture's jurisdiction until 1999, when they were transferred to the newly formed Ministry of Fish Wealth (MFW) [10]. Since Yemen's unification, government policy has supported investments in the fisheries sector with the goal of boosting the industry's overall yield catch. The small-scale segment dominates the fishing industry. In 1999, the total value of fisheries input was $125 million, including $40 million in imports and $19.8 million in exports. In 2009, the fisheries industry contributed $26.24 billion to the national Gross Domestic Product, or 1.9 percent (GDP). In the pre-conflict era, fisheries were the greatest export earner behind oil and gas, accounting for 1.5 percent of the national labor force. Indeed, small-scale fishing provided a living for 83,000 fishermen and 583,600 of their dependents in 2014, totaling 667,000 persons. Severe food shortages, increased hunger, and the threat of starvation have resulted in a virtual collapse of assets essential to protect livelihoods since the outbreak of the present conflict. Fishing, like agricultural productivity, has dropped by more than a third from pre-conflict levels, forcing many fishermen and their families to flee conflict-affected areas [11].

The intensity of conflict has resulted in a severe depression in the fisheries sector since 2015. Individuals whose primary source of income was fishing have been displaced, and many fishing businesses have closed. Government bureaucracy and inactivity to help the industry hamstring those who remain. Regulatory roadblocks include conflicting regulations, high regulatory costs, and a bureaucracy that is unresponsive to industry requests. However, the situation in Aden appears to have been less terrible until lately, since many fishermen from other coastal cities seek new fortunes there [12].

In Aden, the presence and operation of a large number of fishing vessels in three districts of the city, with 5,000 in Attawahi, 1,500 in Craiter, and 6,200 in Al Buraiqeh calling port in six of the city's docks. In addition, two fishing farms and four fish processing and packaging farms constitute the whole fishing sector. There are also four icing factories in the city, which process and store the catch before shipping it from the city for either internal consumption or transshipment to Chinese and European markets [13].

Aden's Import cargo in 2020 (Source: Port of Aden)

Aden has long been one of the most important economic centers in the southern Arabian Peninsula. It is linked to the rest of the nation via three main corridors, one of which connects the agricultural hinterland of Lahj to the country's center.

The city now has three economic growth corridors in which development will occur, both planned and unplanned. This explains the rise of informal settlements in Ber' Ahmed, Buraiqah. Furthermore, these three lanes serve as critical control points for Aden's economic viability, allowing it to regulate its ability to feed the hinterland and accept products for export. On a city-scale, nightlight production is related to GDP, and it might give important information about urban recovery or the presence and emergence of new regions. Aden's nightlight production declined by nearly 50% between 2014 and 2015, implying that economic output dropped dramatically during this time. Furthermore, while Aden emitted far more light than Zinjibar in general, the graphs showed a similar loss and recovery pattern, implying that their economies remained linked throughout the conflict.

Ahmed Salem Bahakim

Economist and energy researcher at South24 Center

:

1- Administration, U. E. (2019, 04 23). Yemen Update. Retrieved from eia.gov: eia.gov

Ireland, P. (2020). Yemen: How Fishing Communities Are Fighting Back. Retrieved from NRC: nrc.no

2- Natheer Alabsi, T. K. (2014, 12). Characterization of Fisheries Management in Yemen: A Case Study of a Developing Country’s Management Regime. Retrieved from Marine Policy 50: researchgate.net

3- Salem, A. (2022). Characteristics, structure and resources of the fishery sector. Retrieved from FAO: fao.org

4- Staff, R. (2013, 11 16). China to Build Power Plants in Yemen, Expand Ports. Retrieved from Reuters: reuters.com

5- Staff, R. (2019, 10 16). UPDATE 1-Yemen's Safer oil company resumes pumping to Arabian Sea terminal - official. Retrieved from Reuters : reuters.com

6- Taib, M. (2019, 04). The Minerals Yearbook YEMEN. Retrieved from United States Geological Survey: researchgate.net

7- USAID. (2016, 09). Property Rights and Resource Governance: Yemen,. Retrieved from USAID Country Profile: land-links.org

8- USAID. (2019, 11). THE FISHERIES SECTOR IN YEMEN. Retrieved from Draft Report: pdf.usaid.gov

9- Wahba, S. (2004). Republic of Yemen: Port Cities Development Program Project. Retrieved from World Bank Group.

10- Yemen and China Enter Aden Port Development Agreement. (2013, 11 15). Retrieved from World Maritime News: world-maritimenews.com

11- Salem, A. (2022). Characteristics, structure and resources of the fishery sector. Retrieved from FAO: fao.org

12- Ireland, P. (2020). Yemen: How Fishing Communities Are Fighting Back. Retrieved from NRC: nrc.no

13- USAID. (2019, 11). THE FISHERIES SECTOR IN YEMEN. Retrieved from Draft Report: pdf.usaid.gov

Abbreviation:

ACT Aden Container Terminal

AFZ Aden Free Zone

CFP Community Focal Point

DPW Dubai Ports World

GDP Gross Domestic Products

GoY Government of Yemen

GRT Gross Registered Tonnage

LNG Liquified Natural Gas

MFW Ministry of Fish Wealth

PDRY People’s Democratic Republic of Yemen

USAID United States Agency for International Development