Aden Oil Refinery - AFP

Last updated on: 15-01-2023 at 5 PM Aden Time

Raad Alrimi (South24)

The governorates of Hadramout and Shabwa in South Yemen are characterized by their oil and gas wealth which constitutes most of the state's energy resources and the main source of revenues upon which the governments rely to provide the money needed to run the state affairs.

However, there has been no positive impact of these resources on people in the concession governorates in particular and South Yemen in general. This is amid decades of "corruption and plunder" accusations since the Yemeni unity in 1990.

Despite the governmental declared statistics about the production and export operations before and after the current crisis, there are growing doubts towards the destination of oil export revenues in the country and the exclusive advantages enjoyed by influential class in the regime and the state at the expense of people.

The oil resources in South Yemen topped the motives of the liberation movement for people who suffer from the lowest standard of living in the world according to several international reports. Many Southerners believe that Northern parties in power have exploited their wealth exclusively.

Over the last years and despite reports about a large and unprecedented decline in oil production due to the war, many questions have been raised about the destination of the oil revenues in South Yemen. This is amid Marib's monopoly of gas revenues according to informed sources who spoke to "South24 Center".

The economic and service deterioration and the corruption accusations against the consecutive Yemeni governments since 2015 have enhanced the demands of "liberating oil wealth" adopted by Southerners and STC involved in the Parity Government [2020] and the Presidential Leadership Council (PLC).

Over the past period, Saudi National Bank has been the main destination of South Yemen’s oil revenues according to informed and official sources who spoke to “South24 Center" in addition to former officials in the Yemeni government including the former Oil Minister Abdulsalam Baaboud.

Oil production

Oil production in South Yemen's fields is still a source of ambiguity and questions due to the deep imbalances and divisions among internal and external influential forces.

According to some studies, there has been no minimum level of transparency regarding the oil production file in Yemen, whether related to real statistics or the standards of dealing with the foreign companies operating in the oil field.

This affects the ability to encourage investments according to one study which added: "Yemen was transformed to an anti-investment country. Those interested in this field circulate that Yemen has become the destination of companies surrounded by suspicions of corruption".

Another study indicated that 75% of the crude oil extracted in South Yemen has not been officially announced.

According to a study, prepared by the Associate Professor at the University of Aden, Hussein Al-Aqel and seen by "South24 Center", 75% of the extracted crude oil didn’t enter the state treasury account.

The study indicated that dealing with these quantities of crude oil was done through “buying and selling at auctions and according to contracts whose parties are mostly Yemeni influential figures and foreign oil companies”.

As per the official statistics, Yemen crude oil revenues in 2021 amounted to 1.418 billion $ compared to 710 million $ in the previous year with a 5% increase (707 million $).

However, these revenues, which have stopped since late 2022 due to the Houthi attacks, were not transferred to the Central Bank of Yemen in Aden but to the Saudi National Bank. The government costs are paid using this money amid a mere oversight role by the Central Bank according to informed sources who spoke to “South24 Center”.

Statements published by the Yemeni Ministry of Finance, seen by “South24 Center”, show the volume of oil revenues that has been disclosed since 2014.

Table (4) the volume of oil exports compared with the entire Yemeni exports from 2014-2021 (million $)

Year | Value of goods and services exports | Oil exports | Percentage of oil exports out of total exports |

2014 | 8,254,00 | 7,233,00 | 87.63% |

2015 | 2,051,00 | 1,643,00 | 80.11% |

2016 | 1,046,80 | 248,00 | 23.6% |

2017 | 1,006,50 | 599,30 | 59.55% |

2018 | 1,308,60 | 914,50 | 69.89% |

2019 | 1,178,20 | 710.50 | 60.3% |

2020 | 1,561,80 | 1,101.00 | 70.5% |

2021 | 1,887,00 | 1,418.00 | 75.1% |

2022 | *2,209,00 | 1,722,00 | 77.9% |

Sources: Statistics of 2014 and 2015 are derived from statements issued by the Oil Ministry and the Ministry of Commerce and Industry in Sanaa while statistics from 2016-2022 are derived from the Central Bank of Yemen of Aden. (See the Arabic Version)

The Saudi National Bank

Exclusive sources who work in the Central Bank of Yemen told “South24 Center" that the Central during a certain phase, especially the era of governor Monasser Al-Quaiti ordered all foreign companies which work in the oil sector to deposit the crude oil sales revenues in the Saudi National Bank.

The sources claimed that what led to this is “the political understandings between the then Yemeni President Abd Rabbuh Mansour Hadi and the Saudi-led Arab Coalition”. According to the sources, “the role of the Central Bank has been limited to supervising paying the government costs and salaries in addition to covering food commodity bonds”.

“South24 Center” contacted the Central Bank leadership, the Oil Ministry and the Ministry of Finance to request comment but there has been no response.

Abdulsalam Baaboud, former Oil Minister [2020-2022] exclusively told “South24 Center” that oil revenues were transferred to the Saudi National Bank.

“This came according to governmental instructions and the banking needs which require dealing with an intermediary bank to transfer the revenues through notifications to the Central Bank of Yemen which disperses them according to the applicable financial procedures," he added.

The exclusive sources said that the Yemeni Ministry of Finance has a delegated office in the Saudi National Bank. Moreover, the ministry is lawfully responsible for all governmental accounts outside the Central Bank and that it has the power to close such accounts.

The sources mentioned a number of government institutions whose revenues went to external banks such as Aden Refinery Company which transferred all its revenues lately to Arab Bank in Jordan and local banks in Aden.

They indicated that the oil revenues transferred to the Saudi National Banks by the sectors are the share of the state-owned Yemen Company for Investment in Oil & Minerals (Yicom) while the shares of the foreign companies go to their own banks.

These operations violate the Yemeni Financial Law no (8) 1990 which stipulates that “It is prohibited for any bodies or companies or organizations to transfer money or open accounts outside the Central Bank of Yemen”.

On December 23rd, Saba New Agency said that the current Minister of Finance Salem Bin Brik issued instructions to close all governmental accounts outside the Yemeni Central Bank and to suspend spending from savings as well as the direct disbursement of revenue.

“South24 Center” didn’t receive a response from the Ministry of Finance about what was implemented from these instructions and the targeted accounts of the directions.

Impacts

STC’s Supreme Economic Committee stressed on the negative impacts related to transferring oil revenues outside the Central Bank of Yemen.

The committee told “South24 Center” that “this certainly has a bad economic impact represented in reducing trading foreign exchange in the state treasury (the Central Bank of Yemen) in addition to the political quotas related to the disbursement process of these accounts”.

”Moreover, this violates the laws of the Ministry of Finance and the Central Bank which in turn plays a limited marginal role in the economic cycle instead of being a high monetary storage," they added.

The Economic Committee attributed this violation to “the desire to provide money for the government parties such as the Yemeni Presidency, consulates, missions abroad and foreign offices of several Yemeni ministries which constitute an economic additional burden”.

Re-export

It seems that the Houthis will continue targeting any oil production or export operation in South Yemen in addition to the current obstacles due to the damages caused by their final attack against the export pump at the Dabba Oil Terminal in Hadramout.

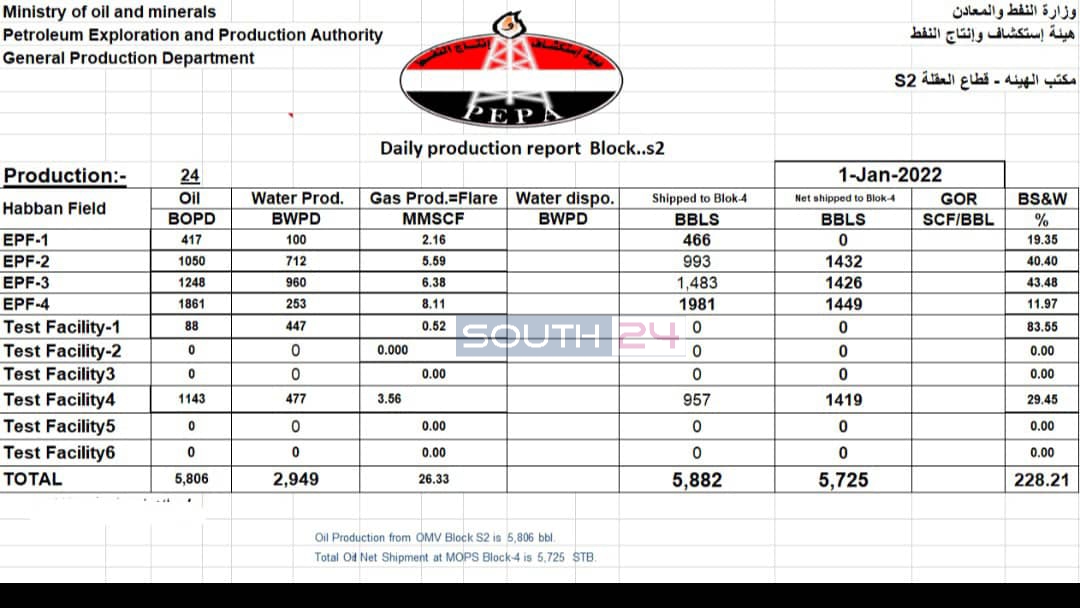

Data from the Yemeni Ministry of Oil showing the volume of oil production from Sector S2 in Al-Uqlah oil field in Shabwa on January 1, 2022.

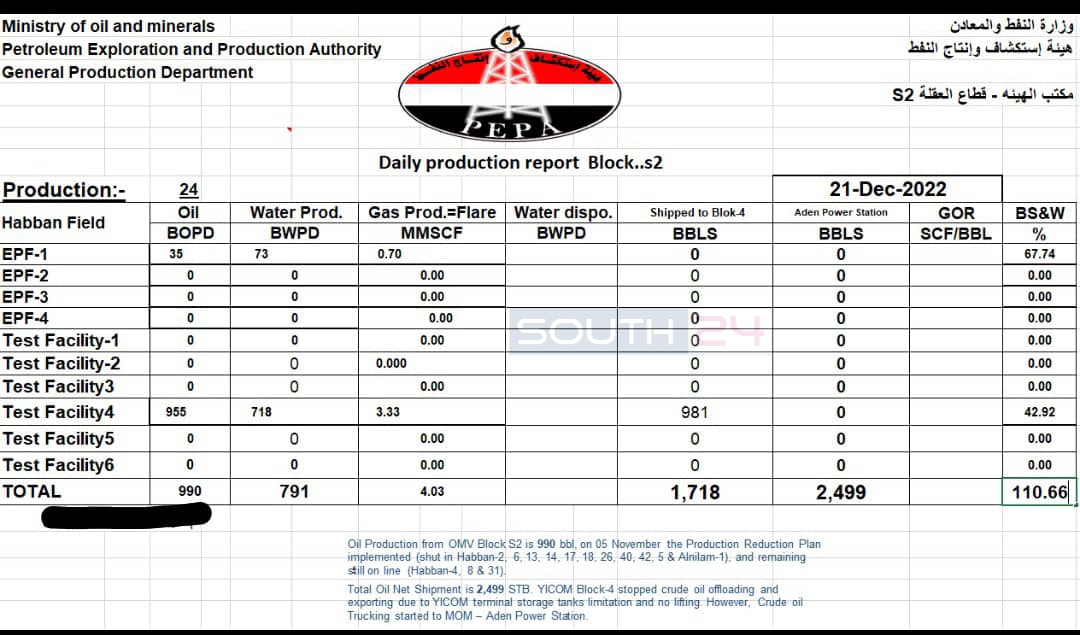

Data from the Yemeni Ministry of Oil showing the volume of oil production from Sector S2 in Al-Uqlah oil field in Shabwa on December 21, 2022.

However, official sources who spoke to “South24 Center” downplayed the impact of this attack on the oil export process. They said that the possibility of exporting oil as in the past is still available for the Yemeni government in natural circumstances.

The sources said: “The Dabba oil terminal has two pumps to send oil to the ships, one of which has not been damaged by the Houthi attack and can replace the damaged first pump to re-exporting oil”.

It is important to refer to the relationship between the oil sector in South Yemen, especially Hadramout and other political and military issues such as the First Military District forces who are deployed in the oil-rich Wadi Hadramout. These forces are accused of protecting the “plunder” operations.

The Hadrami locals consider these forces an “occupation” which helps to exploit their wealth at a time when they live in poor living and service conditions.