A popular market in the city of Mukalla, Hadramout, September 2023 (South24 Center)

Last updated on: 30-03-2024 at 2 PM Aden Time

Yemen is facing an unprecedented economic crisis, and is preparing for unforeseeable outcomes. The already unstable humanitarian and economic conditions in the impoverished Yemeni state are made worse by internal strife and instability.

Ahmed Bahakim (South24 center)

Introduction

Yemen's economic landscape has been marred by significant chaos, particularly towards the end of 2023, as the Internationally Recognized Yemeni Government faced the imminent threat of insolvency. During previous years, the Central Bank of Aden resorted to printing fresh banknotes to settle debts and pay public sector employees, aiming to alleviate its precarious financial predicament. However, these banknotes were rendered ineffective in Yemen's Houthi-controlled territories, leading to a substantial devaluation of the national currency and a deterioration in essential public services, leading to widespread public discontent. [1]

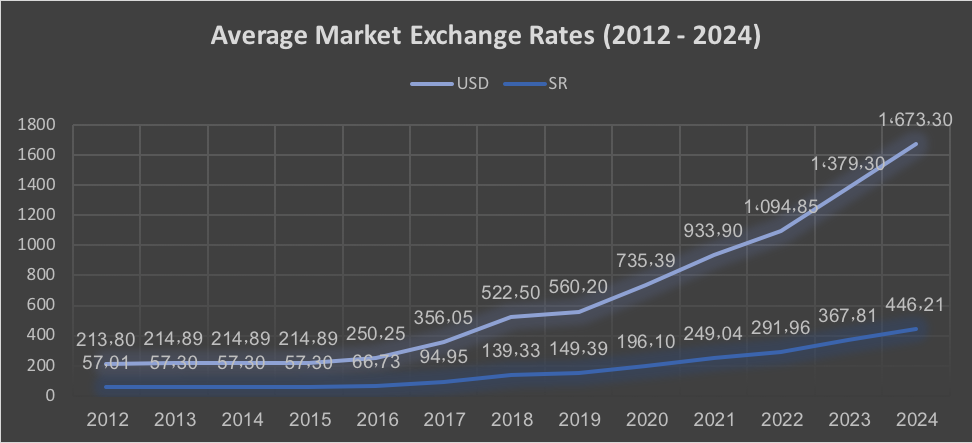

Figure 1: Average market exchange rates (2012-2024). Source: South24 Centre for News and Studies 2024.

Figure 1: Average market exchange rates (2012-2024). Source: South24 Centre for News and Studies 2024.

The repercussions of these economic challenges are evident in the average market exchange rates, as depicted in Figure 1, sourced from the South24 Centre for News and Studies 2024. This data underscores the substantial impact of the financial crisis on the nation's currency exchange rates from the period 2012 to 2024.

In response to the dire economic scenario, the Yemeni government has articulated its intention to leverage a $1.2 billion Saudi aid package to address the budget deficit, sustain employee salaries, and ensure food security, aiming to mitigate the ramifications of the economic catastrophe. However, the current phase of Yemen's economic crisis has been aggravated by escalating economic conflicts stemming from trade restrictions imposed by the Houthi authorities in government-controlled areas. To add to it, internal governmental discord has engendered dysfunction, reduced administrative capacity, amid allegations of corruption, impeding the effective collection of taxes and other public revenues. [2]

The Houthis' intensified offensive against the Internationally Recognized Yemeni Government in late 2022, marked by disruptive drone strikes on the vital energy infrastructure, has precipitated significant economic repercussions. These deliberate attacks on energy facilities in government-controlled regions led to the substantial curtailing of tax, gas, and oil revenues, and thereby to substantial budget deficit and a severely diminished fiscal capacity to meet the essential financial obligations, such as payment of salaries for the public sector and provision of power. [3]

The economic and humanitarian outlook for Yemen appears increasingly dire, with the nation teetering on the brink of an exacerbated crisis. The sustained financial support is imperative to avert a precipitous decline in the humanitarian condition. Alarming levels of malnutrition, with approximately 50% of children under five years suffering from moderate to severe stunting, underscore the severity of the humanitarian crisis. The failure to pay the salaries of hundreds of thousands of public sector workers, and the ensuing financial instability, poses alarming consequences for both these employees and their families, exacerbating an already grim economic conditions. [4]

The deliberate disruption of the Yemeni government's public funding streams by the Houthis, coupled with the multifaceted economic and humanitarian challenges, underscores the urgency of addressing the complex and pressing issues facing Yemen's economy and populace. Immediate and sustained financial assistance is imperative to avert an exacerbation of the crisis and foster a path towards recovery and stability. [5]

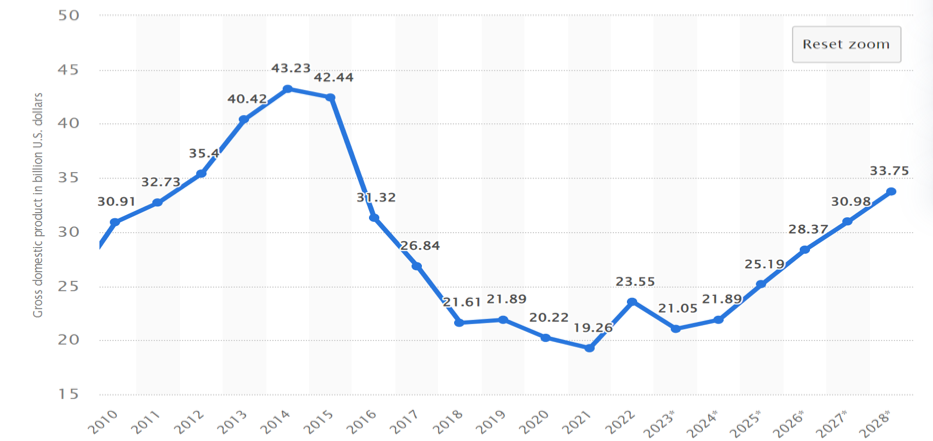

Figure 2: The gross domestic product in current prices in Yemen was forecast to continuously increase between 2023 and 2028 by in total 12.7 billion U.S. dollars [6]

Figure 2: The gross domestic product in current prices in Yemen was forecast to continuously increase between 2023 and 2028 by in total 12.7 billion U.S. dollars [6]

Government Spending and Economic Challenges in Yemen

Yemen’s government expenditure comprises major components such as wages and salaries of public employees, purchase of goods and services, maintenance and debt service, interest payments, and capital outlays. The public sector wage bill is the most prominent budgetary item, accounting for a large share of public spending. [7]

The protracted conflict in Yemen has deepened the fragmentation of the country, resulting in the emergence of two distinct economic zones – one headed by the IRGY and the other by the Iran-backed Houthis, each governed by its own unique set of institutions and policies. This has led to a growing disparity between these zones. In 2022, a glimmer of hope emerged following a UN-brokered truce, although it expired in October of that year. However, an informal truce persisted between the two zones. In 2023, the situation deteriorated due to a blockade imposed by the Houthis on oil exports by the Internationally Recognized Government. This blockade has had severe repercussions on foreign currency liquidity, exacerbating an already precarious fiscal situation of the IRYG. [8]

In addition, the exchange rate on Aden's market has plummeted to historic lows, resulting in price hikes despite a global decline in commodity prices. This has added to the economic woes of the people. [9] Furthermore, Yemen's heavy reliance on remittances and aid inflows, coupled with its vulnerability to the impacts of climate change, has exposed the country to external factors beyond its control. [10]

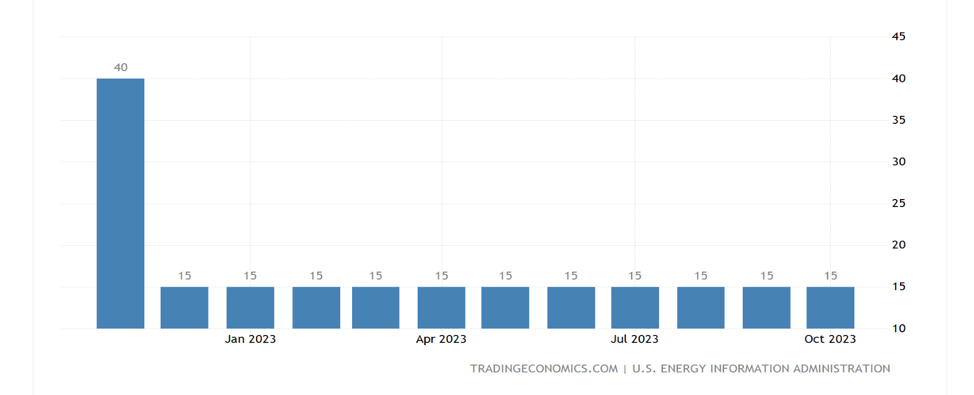

The economic situation in Yemen remains extremely challenging in the absence of a political resolution. The continuation of the war has resulted in a staggering 75% decline in oil revenues. This drastic reduction can be attributed to various factors, including the departure of investors, the winding up of projects, and companies opting to leave the country. Additionally, there has been a complete halt in oil exploration, production, and the export of liquefied natural gas. It is worth noting that the state's oil revenues, which surpassed $2.5 billion in 2013, have now dwindled to less than $1 billion per year since the onset of the conflict. [11] Furthermore, recent attacks by the Houthis on Yemen's oil port terminal in the south have caused an additional billion-dollar loss. [12]

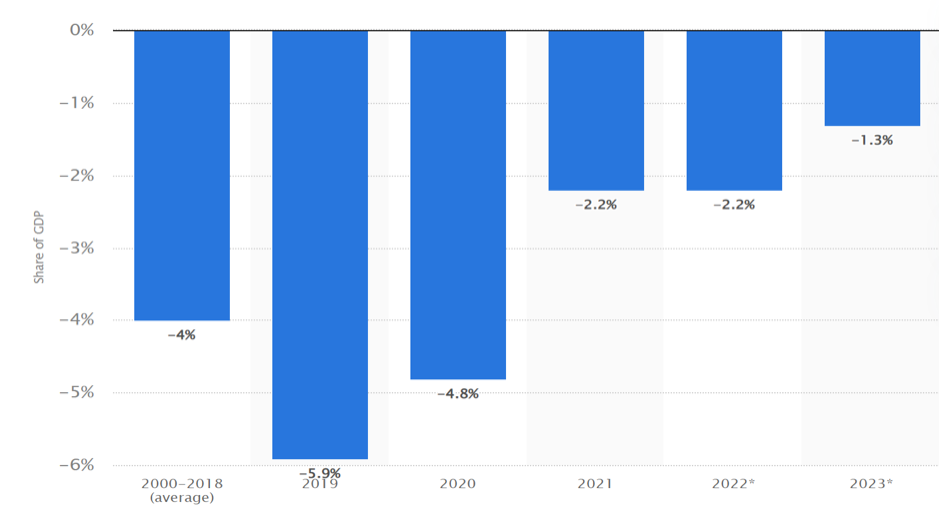

Figure 3: General government fiscal balance in Yemen from 2000 to 2023. [13]

Figure 3: General government fiscal balance in Yemen from 2000 to 2023. [13]

The current diminished revenue is enough to just cover the salaries of civil servants and the pensions of retirees in government-controlled areas, with only a limited amount remaining to sustain a minimum level of public services and ensure the functioning of state institutions. Despite these economic difficulties being faced by the IRYG, the Houthis are continuing to demand a portion of the dwindling oil revenues. Thus, it is evident that without a political resolution, Yemen's economic prospects will continue to remain dire and the challenges will persist. [14]

The Houthis have so far been unwilling to allocate public sector revenues toward the payment of public sector salaries. It is imperative to prevent the Houthis from exploiting the humanitarian issue at hand for their own agenda or to exercise control over the Yemeni population. [15] In fact, by effectively utilizing the revenue generated from the resources under their control, such as oil, gas, and ports, the Houthis have the potential to play a crucial role in stabilizing Yemen's economy and mitigating the impact of the humanitarian crisis. For this, it is essential for the United Nations to ensure that payments reach their intended recipients and are not misused to support the Houthis' illicit activities or fund their supporters. [16]

it is necessary to set up a mechanism to prevent the Houthi militia from seizing or misappropriating revenues, and to ensure proper disbursement of salaries and other expenses by the parties involved in Yemen's conflict. It is also important for the Yemeni government to assume control over the country's primary revenue sources and ensure their equitable distribution. This includes financial resources from the oil sector as well as revenues generated by the port of Hodeida and areas under Houthi control. [17] The failure to do this has contributed to financing the ongoing conflict. It is crucial to address these issues to promote stability, restore economic balance, and facilitate a path towards sustainable peace in Yemen. [18]

Customs and Taxes: Challenges and Corruption

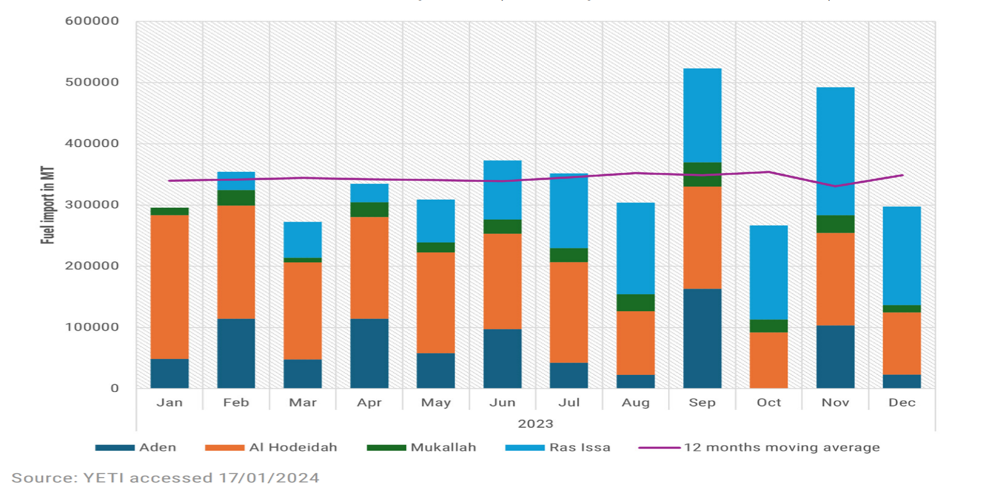

As part of their negotiations with the Saudi government, the Houthi authorities strategically secured the removal of import restrictions imposed by the coalition on the Houthi-held port of Hodeidah. Additionally, they successfully expedited the United Nations' monitoring efforts. In a calculated move to consolidate their power, the Houthi militia has deliberately taken control over the flow of goods by redirecting imports away from the crucial Port of Aden, situated on the Southern coast, and rerouting them to the Port of Hodeidah, located on the Red Sea coast. [19] This intentional maneuver has had devastating economic consequences for the already vulnerable Yemeni population, pushing them further into the depths of poverty. The redirection of imports away from the Port of Aden has disrupted vital trade routes and exacerbated the economic hardships faced by the citizens. This calculated strategy by the Houthi militia has resulted in a significant deterioration of the economic conditions in Yemen.

The strategic planning of the Houthis to control imports in Yemen coincided with the Yemen government's controversial attempt to increase its own revenues through higher customs duties. The Yemeni government's mismanagement and implementation of economic reforms have played a role in enabling the Houthi militia to gain control over imports. The government's measures, such as raising the rate of the customs dollar and increasing the taxes on essential goods and services, have had an adverse effect on the country's economic stability. These have led to an escalation in import costs, resulting in inflation and a decrease in the purchasing power of Yemeni citizens. Consequently, the economic hardships faced by the population have created favorable conditions for the Houthi militia to exploit the situation to their advantage. [20]

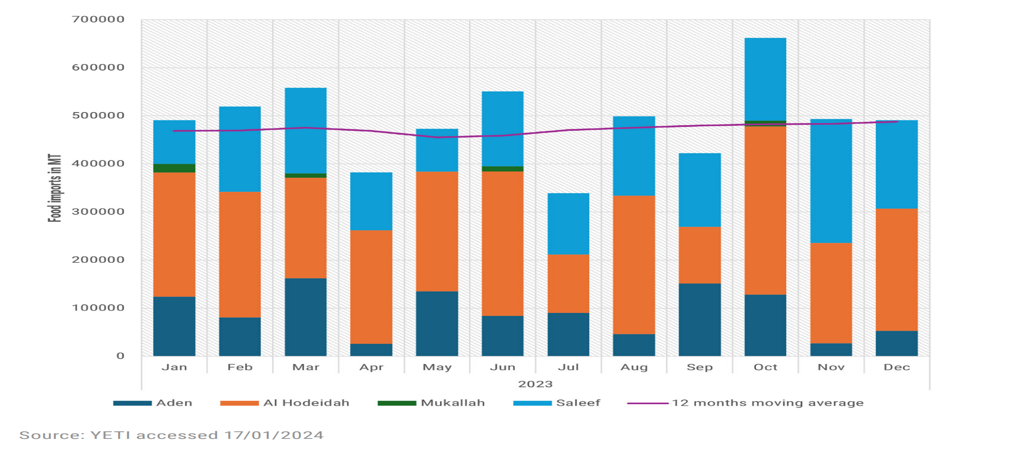

It is important to note that the Yemen government's policies, intended to implement necessary economic reforms, have inadvertently contributed to the current state of affairs. This highlights the need for comprehensive and effective economic management strategies that prioritize the well-being of Yemeni citizens and prevent the exploitation of economic hardships for political gain. Data from the Assessment Capacities Project (ACAPS) Yemen Economic Tracking Initiative has revealed a notable decline in imports through the Port of Aden, further emphasizing the economic consequences of the Houthi authorities' control over imports and the need for a comprehensive approach to address the situation. [21]

Figure 4: Food imports to Yemen by port (January to December 2023). [22]

Figure 4: Food imports to Yemen by port (January to December 2023). [22]

Figure 5: Fuel imports to Yemen by port (January to December 2023). [23]

Figure 5: Fuel imports to Yemen by port (January to December 2023). [23]

Tax and customs revenues play a vital role in the national income, and constituted approximately 41 percent of the Yemeni government's revenues in 2022. There was an increase in tax revenues, including fees, with customs duties reaching 208.9 billion riyals, reflecting a growth rate of 36%. The overall value of tax revenues reached 789.5 billion riyals, showing a significant increase of 290.8 billion riyals or 100.4% compared to the previous year. However, the contribution of tax revenues to the total public revenues decreased from 52.9% in 2021 to 41.2% in 2022. [24]

The proportion of tax revenues in relation to the gross domestic product (GDP) stood at approximately 3.4% in 2022, demonstrating a slight rise compared to the 3.3% recorded in the preceding year. This indicates a modest elevation in the relative importance of tax revenues in comparison to the size of the economy during this period. This trend of low tax compliance is further compounded by inefficiencies in the collection of customs duties and taxes, which are compounded by widespread corruption. Corruption within public entities operating under the purview of the government-affiliated Tax Authority serves as a catalyst for taxpayers to evade compliance, resulting in significant revenue loss for the government. [25]

In light of the decline in the volume of public resources in relation to the increase in public spending, the internal public debt has risen. This increase can be attributed to the decision made in September 2016 to transfer the operations of the Central Bank of Yemen to Aden capital. In 2022, the internal public debt reached a value of 4,442 billion riyals, reflecting an increase of 811.4 billion riyals or 23.2% compared to the previous year.

Direct borrowing from the issuing central bank served as the primary means of financing the internal public debt, with the basic cost of financing amounting to 4,309.7 billion riyals in 2022, as opposed to 3,498.3 billion riyals in the previous year. Consequently, the share of the total internal public debt increased from 94.8% in 2021 to 97% in 2022. Certificates of Deposit represented the second source of internal public debt, valued at 132.3 billion riyals in 2022. However, their proportion of the total internal public debt decreased from 5.2% in 2021 to 3% in 2022. [26]

Adding to the complexity, the government faces limitations in capacity and administrative reach. The demands of the ongoing conflict have consumed valuable resources and attention, leaving little room to effectively address the intricate challenges at hand. The unpaid salaries, unauthorized checkpoints, and constrained government capabilities has created a difficult environment where finding solutions to these problems remains elusive. [27]

Oil and Gas: Yemen's Economic Battleground

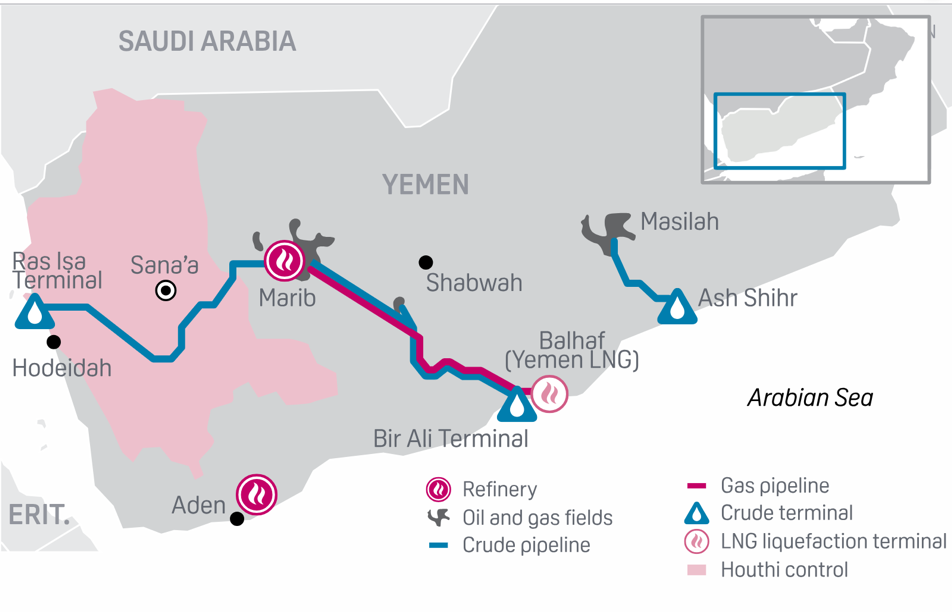

The oil and gas sector in Yemen has historically been a source of political tension, with the export earnings it generates being essential to the nation's economic structure. The historical politicization and contestation of these income sources continues even in the middle of the ongoing conflict. Before the war, Yemen's gross domestic product, foreign exchange reserves, total goods exports, and national budget financing were mostly funded by oil and gas royalties. But the violence that erupted in 2015 brought a near-halt to the gas and oil exports, significantly cutting into the income. [28]

Figure 6: Yemen's oil and gas infrastructure. Source: S&P Global Platts.

Figure 6: Yemen's oil and gas infrastructure. Source: S&P Global Platts.

In 2023, the expiration of the UN-sponsored truce resulted in a number of adverse economic developments that made it a difficult year for the country's economy. The Houthi faction's embargo had a significant effect on oil shipments and production. Furthermore, there was a decrease in demand for gas coming from outside of Houthi control areas as a result of a calculated move to import household butane gas into Houthi-controlled areas. In addition, the economy encountered challenges including unstable currency exchange rates, elevated inflation, and increased societal discontent, all of which hurt the non-oil sector, which includes the private sector. Consequently, Yemen's GDP was forecast to shrink by 0.5% in 2023. [29]

In areas under the Internationally Recognized Government of Yemen, fiscal strains increased, mostly as a result of stagnating oil exports. There was a significant drop in the revenue of the IRYG in the first half of 2023,. The decrease in customs earnings as a result of imports being diverted away from the Aden port compounded this downturn. To protect the state finances, the Internationally Recognized Government made large expenditure cutbacks in response to falling income. These actions also made it more difficult to provide vital public services and encourage sustained economic growth. [30]

Figure 7: Yemen Crude Oil Production. [31]

Figure 7: Yemen Crude Oil Production. [31]

Due to these financial difficulties, the Internationally Recognized Government had to use its overdraft facility at the Central Bank of Yemen in Aden (CBY-Aden). As a result, government claims increased by 10% in the first half of 2023, and there was a 5% inflation in currency circulation. Although overall inflation decreased in the wake of the drop in commodity prices globally, regional variations in inflation were substantial. Sana'a has had a sharper decrease in consumer price inflation, whereas Aden saw higher rates as a result of exchange rate depreciation.

Yemen's economic situation is still unclear in 2024 because of restrictions on oil exports and the ongoing political talks. Economic stability is dependent on both steady foreign exchange inflows and advancements in the political process. A long-term ceasefire or peace accord, however, may quickly boost Yemen's economy. A World Bank analysis that evaluated economic activity during the UN-brokered truce in 2022 using cutting-edge night-time light (NTL) emission data finds that there was a notable spike in activity during the brief truce. However, the Yemeni economy's fragmentation due to political issues must be resolved if the country is to see long-term success. Yemen's recovery will depend on an equitable peace agreement that tackles structural problems, grievances connected to the conflict, and economic obstacles. [32]

Telecommunication utilities

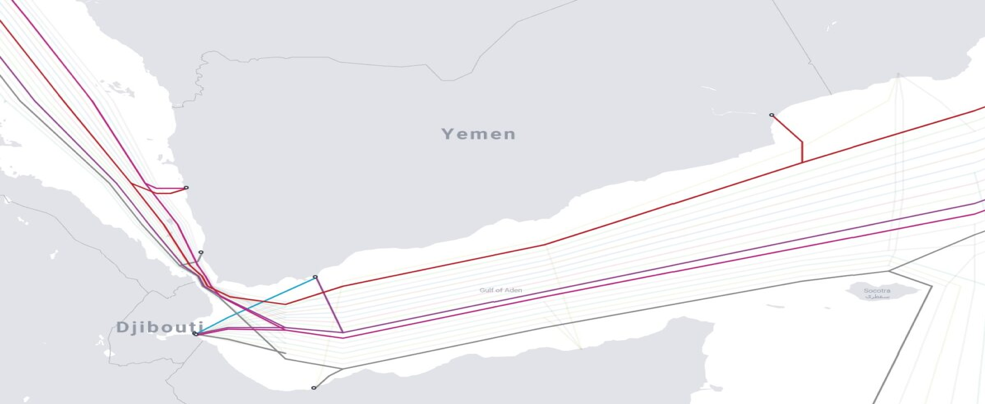

The crisis has had a significant impact on Yemen's telecommunications and information technology sector, which was once the country's second-largest source of income behind the oil and gas sector. The industry, which is mostly run in Sana'a, has suffered significant losses of an estimated US$4.1 billion as a result of the conflict-related destruction of infrastructure, the seizure of equipment, and limitations on operations. The separation of telecommunications institutions and businesses between the warring parties has further crippled the industry and reduced its ability to operate at the national level. [33]

In regions under their control, the Houthis have developed the telecommunications industry to cater to the growing demand for internet and mobile services. This has allowed them to maximize tax revenues. On the other hand, the government's dispersed political and economic management has made it more difficult for it to fulfill the telecommunications demand and take advantage of the expanding market for services in the regions that fall within its purview. For the people, accessibility issues have been made worse by the restricted growth of services, especially the Aden Net's use of 4G technology, which has led to expensive modems and a thriving black market. [34]

Figure 8: Yemen's Internet and telecommunications international gateways. [35]

Figure 8: Yemen's Internet and telecommunications international gateways. [35]

There is a possibility for the government to increase its fiscal receipts by redirecting international calls through companies located within government territories in order to collect related fees. However, despite opposition in parliament, a sizable portion of the public operator was recently sold to an Emirati corporate, raising questions about the deal's financial ramifications. [36]

The Houthi treasury has received more cash from the telecom sector than from the oil and gas industry. Billions of dollars have been poured into the Houthi coffers due to the lack of official data and the distribution of income among influential Sana'a personalities and the state. The Houthis attribute the large income from the telecom industry in part to the enforcement of high levies and taxes on recharge vouchers and cards. [37]

The telecommunications sector in Yemen, once a vital source of revenue, has been deeply affected by the conflict. There is paramount need for transparent governance and effective revenue management within the sector to address the economic challenges and promote sustainable development.

Electricity utilities

The conflict has caused significant damage to Yemen's power facilities, transmission, and distribution networks, negatively affecting the nation's energy infrastructure. In areas under Houthi control, the public grid has suffered severe damage, rendering most governorates without regular access to energy. On the other hand, in IRYG areas, although the public grid is operating, it is still erratic and unreliable. With just a tiny percentage of houses getting power from the public grid, dependence on alternative energy sources—particularly small-scale solar household systems—has grown. These systems provide limited electricity, mostly for lighting and phone charging. In government-run areas, those who are linked to the operational grid get electricity only for a few hours per day and at sporadic, cheap prices. [38]

Related to: Recommended Reforms for Electricity Utilities in Yemen: Obstacles and Recommendations (south24.net)

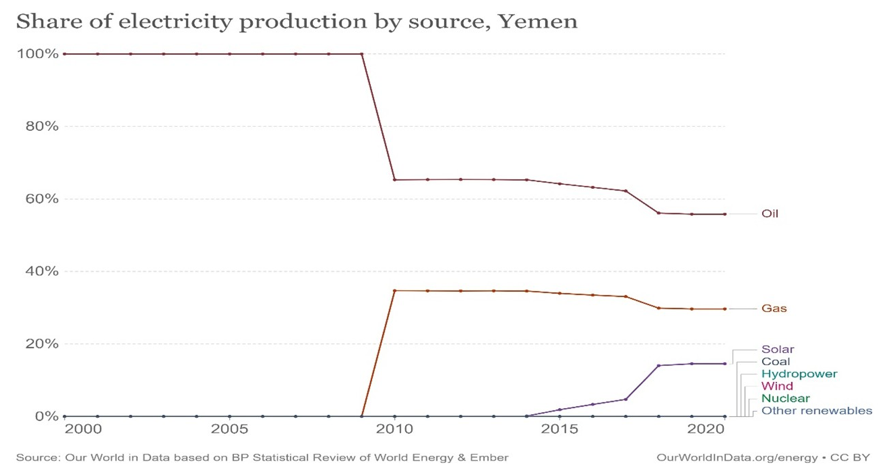

Figure 9: Share of electricity production by source in Yemen. Source: ourworldindata.org

Figure 9: Share of electricity production by source in Yemen. Source: ourworldindata.org

Yemen relies mostly on heavy fuel oil (HFO) and diesel for the production of energy. The fighting and import prohibitions at Red Sea ports have made it extremely difficult to get petroleum. Market supplies have been strengthened by initiatives to liberalize imports and enter into gasoline supply agreements with the Kingdom of Saudi Arabia. However, in order to maintain power plant operations through the private sector, the government must guarantee consistent fuel payments. It is expected that in the near future, efforts to renovate the Aden refinery and switch to other fuels and technologies, such as renewable energy and natural gas, would lower expenses and improve energy accessibility. In the medium run, initiatives to boost fuel efficiency and increase supplier competitiveness could also be beneficial. [39]

Aden's electrical system experiences severe losses because of a large number of illegal connections and failing transmission and distribution networks. In 2021, government-controlled governorates collected less than 50% of the billed amount, indicating disparities in collection effectiveness between customer categories and governorates. Collection rates for billed power remain significantly low. Roughly two-thirds of the bills are paid by homeowners, while just 10% is covered by the government for electricity. [40]

Value for money should be given top priority in the government's plan to rebuild generation, transmission, and distribution, with an emphasis on incremental capacity and coverage benefits from investments. Tariffs provide only a small portion of the Public Electricity Corporation (PEC) expenditure linked to electricity distribution. While higher tariffs could be a source of income, it would make the humanitarian issue worse. In order to expand supply to fulfill demand from those who can afford it, providers should look into ways to offer more electricity at commercial pricing to particular consumer groups or geographic areas. This way, individuals who are already struggling financially won't be further burdened. [41]

The difficulties Yemen's electrical industry faces highlights the critical need for calculated risks, creative fixes, and fair legislation to handle the complicated energy environment and guarantee reliable and affordable power supply throughout the nation.

Recommendations for Addressing the Economic Crisis in Yemen

Yemen is facing an unprecedented economic crisis, and is preparing for unforeseeable outcomes. The already unstable humanitarian and economic conditions in the impoverished Yemeni state are made worse by internal strife and instability. On February 5, 2024, Rashad Al-Alimi, the Chairman of the Presidential Leadership Council, announced the selection of Ahmed Awad bin Mubarak as Yemen's next Prime Minister in order to tackle the country's imminent bankruptcy and promote a path towards economic recovery. [42][43] Alongside this significant event are the following suggestions for the formation of a new government: The following research and studies are suggested by the South24 Center for News and Studies to solve Yemen's economic crisis:

Oil and Gas

Diversification of Energy Sources: Given the impact of the Houthi-imposed blockade on oil production and exports, it is imperative to explore alternative energy sources to reduce reliance on traditional oil exports. Investing in renewable energy initiatives, such as solar and wind power, can help mitigate the adverse effects of disruptions in oil production and exports.

Strengthening Domestic Gas Production: To counter the decline in demand for gas sourced from non-Houthi regions, efforts should be directed towards enhancing domestic gas production. This can be achieved through strategic investments in exploration and production activities, as well as the implementation of policies to incentivize domestic gas utilization.

Addressing Currency Volatility and Inflation: To support the non-oil sector, particularly the private sector, measures should be taken to stabilize currency exchange rates and curb inflation. This may involve implementing monetary policies aimed at maintaining exchange rate stability and controlling inflationary pressures.

Enhancing Import Infrastructure: Given the redirection of imports from Aden to Houthi-controlled ports, there is a need to improve import infrastructure and logistics to ensure efficient and equitable distribution of imports across different regions. This may involve upgrading port facilities and establishing alternative trade routes to mitigate the impact of import redirection.

Economic Diversification and Resilience: To mitigate the impact of stagnant oil exports and declining revenues, there should be a concerted effort to diversify the economy and build resilience in non-oil sectors. This can be achieved through targeted investments in industries such as agriculture, manufacturing, and services, thereby reducing the economy's dependence on oil revenues.

Customs, Taxes, and Oversight

Fiscal Reforms and Revenue Generation: In response to declining revenues, the government should focus on implementing fiscal reforms to enhance revenue generation. This could involve measures to improve tax collection, combat corruption, and streamline customs procedures to ensure efficient revenue mobilization.

Strengthen Oversight and Monitoring: Implement robust oversight and monitoring mechanisms to prevent the deliberate redirection of imports away from vital ports. This includes enhancing the United Nations' monitoring efforts and establishing transparent processes to ensure the equitable flow of goods through all ports, thereby mitigating the adverse economic consequences caused by import redirection.

Promote Economic Diversification: Encourage economic diversification to reduce dependence on customs and tax revenues. This can be achieved through targeted investments in non-oil sectors, such as agriculture, manufacturing, and services, to create alternative sources of income and reduce reliance on customs and tax revenues.

Strengthen Debt Management: Develop comprehensive strategies for managing the internal public debt, including measures to address the increase in public spending relative to the decline in public resources. This may involve prudent fiscal management, expenditure prioritization, and debt restructuring to mitigate the impact of rising internal public debt on the economy.

Electricity Utilities

1. Diversification of Energy Sources: Given the critical electricity crisis in South Yemen, efforts should be directed towards diversifying energy sources to reduce reliance on fuel for power generation. This may involve exploring renewable energy initiatives, such as solar and wind power, to supplement traditional fuel-based power generation and mitigate the impact of fuel shortages on electricity provision.

2. Enhanced Infrastructure and Maintenance: Prioritizing infrastructure development and maintenance to ensure the efficient functioning of power plants and electricity distribution networks. This includes upgrading existing power generation facilities, transmission lines, and substations, as well as implementing measures to prevent looting of fuel derivatives from power stations, thereby safeguarding the reliability of electricity supply.

3. Efficient Revenue Collection: Addressing the limited collection of utility payments by implementing measures to improve the collection of electricity tariffs. This may involve streamlining billing processes, enhancing transparency, and combating widespread corruption within the electricity sector to ensure that utility payments contribute to sustaining and improving electricity provision.

4. Subsidy Reform and Pricing Mechanism: Undertaking a comprehensive review of electricity subsidies to address inefficiencies and corruption while ensuring equitable access to electricity. Reforming the subsidy system and establishing a transparent pricing mechanism can help mitigate the economic burden of electricity provision and promote efficient resource allocation within the electricity sector.

5. Capacity Building and Governance: Focusing on capacity building and governance reforms within the electricity sector to enhance management practices, operational efficiency, and financial accountability. This may involve training programs for electricity sector personnel, instituting transparent governance structures, and implementing effective management practices to optimize electricity provision.

6. International Support and Collaboration: Seeking international support and collaboration, leveraging partnerships with organizations such as the Saudi Development and Reconstruction Program for Yemen (SDRPY) and the World Bank to bolster efforts aimed at improving electricity provision. Collaborative initiatives can facilitate the implementation of sustainable electricity projects and infrastructure development to address the electricity crisis in Yemen.

Telecommunication Utilities

1. Infrastructure Restoration: Prioritizing the restoration and rebuilding of the telecommunications infrastructure that has been damaged due to the conflict. This includes the replacement of seized equipment and the repair of damaged facilities.

2. Transparent Governance: Implementing transparent governance within the telecommunications sector to ensure fair distribution of income and prevent the misuse of funds. This includes the establishment of clear policies and regulations that govern the operations of the sector.

3. Effective Revenue Management: Developing effective revenue management strategies to maximize the sector's income. This could involve the redirection of international calls through companies located within government territories, as well as the enforcement of reasonable levies and taxes.

4. Service Expansion: Addressing the population's accessibility issues by expanding the range of services offered, particularly in regions under government control. This includes the wider adoption and distribution of 4G technology to meet the growing demand for internet and mobile services.

5. Technology Adoption: Encouraging the adoption of advanced technologies to improve the quality and efficiency of services. This could involve the introduction of more affordable modems to counter the emergence of a black market.

6. Strategic Partnerships: Considering forming strategic partnerships with international telecommunications companies to boost the sector's capabilities and financial resources. However, such deals should be made transparently and with the consideration of their financial implications.

Economist and energy researcher, Researcher at South24 Center for News and Studies

- To download the full paper (click here)

[1] "Saudi Arabia to Give Yemen $1.2 Billion Support to Back Budget." 01 Aug. 2023, https://www.bloomberg.com/news/articles/2023-08-01/saudi-arabia-to-give-yemen-1-2-billion-support-to-back-budget.

[2] "Parties in Yemen Must Seize Opening Presented by Regional ...." 15 Mar. 2023, https://press.un.org/en/2023/sc15228.doc.htm.

[3] "Houthi Offensive ‘Primary Obstacle’ to Peace in Yemen, Says U.S ...." 10 Feb. 2022, https://www.usip.org/publications/2022/02/houthi-offensive-primary-obstacle-peace-yemen-says-us-special-envoy-lenderking.

[4] "Yemen Humanitarian Needs Overview 2024 (January 2024)." 01 Feb. 2024, https://yemen.un.org/en/259542-yemen-humanitarian-needs-overview-2024-january-2024.

[5] "The Red Sea Front – The Yemen Review, November and December 2023 - Sana ...." 27 Dec. 2023, https://sanaacenter.org/the-yemen-review/nov-dec-2023.

[6] "Yemen - gross domestic product (GDP) 1998-2028 | Statista." 24 Nov. 2023, https://www.statista.com/statistics/524134/gross-domestic-product-gdp-in-yemen/.

[7] "Yemen Government Spending - TRADING ECONOMICS." https://tradingeconomics.com/yemen/government-spending.

[8] "Yemen: Eight years of unresolved conflict deepen economic crisis." 13 Apr. 2023, https://www.rescue.org/eu/article/yemen-eight-years-unresolved-conflict-deepen-economic-crisis.

[9] "Yemen Overview: Development news, research, data | World Bank." 25 Jan. 2024, https://www.worldbank.org/en/country/yemen/overview.

[10] "Yemen currency clash deepens crisis in war-torn country." 22 Aug. 2021, https://www.aljazeera.com/news/2021/8/22/yemen-currency-clash-deepens-crisis-in-war-torn-country.

[11] "The dilemma of public sector salary payments in Yemen." 23 Feb. 2023, https://www.mei.edu/publications/dilemma-public-sector-salary-payments-yemen.

[12] "Despite Ongoing Challenges, Parties to Yemen Conflict Showing ...." 17 May. 2023, https://press.un.org/en/2023/sc15284.doc.htm.

[13] "Yemen: general government fiscal balance 2023 | Statista." 29 Jun. 2023, https://www.statista.com/statistics/1396188/yemen-general-government-fiscal-balance/.

[14] "The dilemma of public sector salary payments in Yemen." 23 Feb. 2023, https://www.mei.edu/publications/dilemma-public-sector-salary-payments-yemen.

[15] Ibid

[16] "The Houthis' embargo on Yemen's oil exports - Middle East Institute." 09 Dec. 2022, https://www.mei.edu/publications/houthis-embargo-yemens-oil-exports.

[17] Ibid

[18] "BTI 2022 Yemen Country Report." https://bti-project.org/en/reports/country-report/YEM.

[19] "In Yemen, Saudi Arabia and the Houthis Need the U.N. to Secure a ...." 08 Nov. 2023, https://foreignpolicy.com/2023/11/08/yemen-saudi-arabia-houthis-peace-deal-un/.

[20] "The Economic Consequences of the Ports War In Yemen - south24.net." 05 Sept. 2023, https://south24.net/news/newse.php?nid=3515.

[21] ACAPS | https://www.acaps.org/en/countries

[22] "YETI | Yemen Economic Tracking Initiative." https://yemen.yeti.acaps.org/monitoring-timeline/.

[23] "YETI | Yemen Economic Tracking Initiative - ACAPS." 31 Dec. 2023, https://yemen.yeti.acaps.org/.

[24] "Customs Yemen." https://customs-ye.com/eng/eng.php.

[25] "Monetary and Financial Developments January 2023 - english.cby-ye.com." https://english.cby-ye.com/files/64b3a15f7899f.pdf.

[26] “Annual report of the Central Bank of Yemen 2022” https://www.cby-ye.com/files/64a1f54c878e1.pdf.

[27] "Monetary and Financial Developments - english.cby-ye.com." https://english.cby-ye.com/files/6303431ed26c1.pdf.

[28] "Oil’s Impact on Tensions in Southern Yemen - The Washington Institute." 09 Aug. 2019, https://www.washingtoninstitute.org/policy-analysis/oils-impact-tensions-southern-yemen.

[29] "Truce Providing Serious Opportunity for Ending Yemen’s ... - UN Press." 17 Apr. 2023, https://press.un.org/en/2023/sc15258.doc.htm.

[30] "Yemen Economic Monitor, Fall 2023: Peace on the Horizon? [EN/AR]." 27 Oct. 2023, https://reliefweb.int/report/yemen/yemen-economic-monitor-fall-2023-peace-horizon-enar.

[31] "Yemen Crude Oil Production - TRADING ECONOMICS." https://tradingeconomics.com/yemen/crude-oil-production.

[32] "Yemen: End of nationwide truce heralds ‘heightened risk of ... - UN News." 13 Oct. 2022, https://news.un.org/en/story/2022/10/1129517.

[33] "Telecom Companies are the Houthis’ Economic and Security Lungs in South ...." 14 Nov. 2021, https://south24.net/news/newse.php?nid=2219.

[33] "New CEP Report Addresses Houthi Oppression Of Yemeni Telecom, Internet ...." 25 Oct. 2023, https://www.counterextremism.com/press/new-cep-report-addresses-houthi-oppression-yemeni-telecom-internet-services.

[34] "YEMEN: Internet and Telecommunications are NOT Military Targets ... - SMEX." 24 Jan. 2022, https://smex.org/yemen-internet-and-telecommunications-are-not-military-targets/.

[35] "Impacts of the War on the Telecommunications Sector in Yemen." 11 Jan. 2021, https://sanaacenter.org/publications/main-publications/12721.

[36] "Yemen Information & Communication Technology (ICT) - The World Bank." https://documents.worldbank.org/curated/en/337651508409897554/pdf/120531-WP-P159636-PUBLIC-Yemen-ICT-Policy-Note-Input-to-PN-4.pdf.

[37] "Recommended Reforms for Electricity Utilities in Yemen: Obstacles and ...." 23 Apr. 2022, https://south24.net/news/newse.php?nid=2647.

[38] "Reinvigorating Yemen’s electricity system: Avenues for reform in the ...." 12 Jan. 2022, https://www.theigc.org/blogs/escaping-fragility-trap/reinvigorating-yemens-electricity-system-avenues-reform-midst-war.

[39] "A review of Yemen’s current energy situation, challenges, strategies ...." 21 Jun. 2022, https://link.springer.com/article/10.1007/s11356-022-21369-6.

[40] "Models for engaging the private sector in electricity provision in Yemen." 04 Apr. 2023, https://www.theigc.org/publications/models-engaging-private-sector-electricity-provision-yemen.

[41] "Yemen appoints Foreign Minister Ahmed Awad bin Mubarak as prime ...." 05 Feb. 2024, https://www.aljazeera.com/news/2024/2/5/yemen-appoints-foreign-minister-ahmed-awad-bin-mubarak-as-prime-minister.

[42] "Ahmed bin Mubarak appointed as Yemen's Prime Minister." 06 Feb. 2024, https://south24.net/news/newse.php?nid=3797.