By the author

Last updated on: 20-01-2024 at 9 AM Aden Time

The Houthi attacks in the Red Sea have not only disrupted global shipping and trade but have also precipitated a series of complex economic challenges. As the world closely monitors the unfolding events, the impact of these attacks remains a critical concern.

Ahmed Bahakim (South24 Center)

INTRODUCTION:

In the wake of the "Tofaan Al-Aqsa" operation launched by the Al-Qassam Brigades against Israel, tensions escalated as the Houthi group in Yemen, joined the battle against Israel. The Houthis justify this move as a response to the relentless war imposed by the Israel on the people of Gaza Strip. With control over the northwest region of Yemen, the Houthis found themselves just 2200 kilometers away from the heart of the occupied territories.

On October 19, the Houthis unleashed a series of attacks, utilizing cruise missiles and drones, aimed at Israeli targets across the Red Sea. At this critical juncture, the American destroyer USS Carney had recently arrived in the northern Red Sea from the Mediterranean. The missiles and drones were intercepted by the USS Carney before reaching their intended destinations. [1]

This initial attack was just the beginning as the Houthi assaults continued throughout late October, employing medium-range ballistic missiles named Volcano 3 and drones. Responding to the escalating threat, the Israeli occupation army initiated the use of the long-range missile defense system called Arrow 3, with support from American naval forces stationed in the Red Sea.

Examining the map, we discover that the Houthis possess a highly advantageous position due to their proximity to the Bab el Mandeb Strait, a crucial waterway connecting the Indian Ocean to the Red Sea and the Suez Canal. With the strait's narrow width of only 30 kilometers, the Houthis' strategic advantage becomes evident. [2]

In a strategic shift, the Houthis altered their attack strategy in mid-November, targeting commercial ships transiting the Bab al-Mandab Strait. Armed with a vast arsenal of anti-ship ballistic missiles and numerous drones, they posed a significant threat to any vessel crossing the strait. Whether through rocket strikes, boarding using small boats, or helicopter landings, the Houthis aimed to impact the Israeli economy by targeting commercial ships associated with Israel.

Consequently, the Israeli maritime trade, which plays a pivotal role in its economy, found itself under siege. The Houthis' attacks, combined with the Palestinian resistance's actions, placed Israeli ports at risk, including the strategically located Port of Eilat on the Red Sea and the Port of Ashkelon on the Mediterranean Sea, bordering the Gaza Strip. [3]

The Houthi assaults, totaling 24 attacks between November 19 and January 3, have reverberated beyond Israel. The global economy, reliant on smooth international trade, experienced disruptions that surpassed those witnessed during the COVID-19 pandemic. Shipping across oceans constitutes the primary mode of transportation for international trade, with approximately 90% of global trade conducted via sea routes. [4]

Figure 1: By the author

Figure 1: By the author

In this crucial article, we delve into the unfolding crisis in the Red Sea, exploring the far-reaching repercussions of the Houthi attacks on all parties involved. We will dissect the impact on the Suez Canal, a vital artery in global supply chains, and shed light on the significance of this strategic canal. Additionally, we will analyze the effect of Houthi attacks on shipping giants worldwide and the exorbitant costs associated with redirecting maritime routes from the Red Sea to the Cape of Good Hope in southern Africa. This article is a must-read, providing a comprehensive understanding of the events transpiring in the Red Sea and their implications for the global economy.

INTERDEPENDENCE OF THE SUEZ AND PANAMA CANALS:

The Suez and Panama Canals share a symbiotic relationship, as they both enable efficient and cost-effective shipping routes. Any disruption or closure of one canal can lead to increased traffic in the other, straining its capacity and potentially causing economic repercussions. The interdependence of these canals, examining historical instances where disruptions in one canal resulted in increased traffic through the other. Understanding this interrelationship is crucial for anticipating the consequences of Houthi attacks on global trade and devising contingency plans to ensure uninterrupted commerce. [5]

By examining the intentional and unintentional effects of the Houthi attacks, we aim to shed light on the far-reaching consequences for global trade and the global economy as a whole. As we delve into the disturbances unfolding in the Red Sea, it is essential to first understand the significance of the Panama Canal in Central America. This artificial waterway, spanning approximately 82 kilometers, competes with the Suez Canal as a vital navigational passage. Serving as a shortcut for ships traveling between East Asia and the eastern coast of the United States, the Panama Canal plays a crucial role in international commerce. [6]

Figure 2: Panama Canal (By the author)

Figure 2: Panama Canal (By the author)

Compared to its counterpart, the Suez Canal, the Panama Canal offers a five-day reduction in travel time between New York and Shanghai for ships traveling at an average speed. Handling around 5% of global maritime trade, the canal is particularly instrumental in facilitating the transportation of American fuel and grains destined for Asia. Moreover, it serves as the largest source of income for the Panamanian economy, generating $4.3 billion in 2022 alone. [7]

However, the Panama Canal has encountered significant challenges in recent months, threatening its operations. Last October, the region experienced its driest period since at least 1950, primarily due to the climatic phenomenon known as El Niño. This phenomenon adversely affected rainfall and temperatures worldwide, impacting the Panama Canal's freshwater-based infrastructure. [8]

Figure 3: Suez - 192 km Canal (By the author)

Figure 3: Suez - 192 km Canal (By the author)

Unlike the Suez Canal, which operates at sea level, the Panama Canal relies on artificial lakes and operates with a system of locks that raise ships for entry and exit. This reliance on freshwater makes the canal susceptible to drought, necessitating adequate rainwater for its operation. As water levels decreased in recent months, the number of ships passing through the canal significantly declined, affecting its maximum capacity. While the canal typically accommodates 38 to 40 ships daily, this number has dwindled to 22 ships and is projected to decrease further to 18 ships by February. [9]

Consequently, the decrease in ship traffic through the Panama Canal, coupled with reduced cargo capacity and increased traffic fees, has prompted international shipping companies to redirect their voyages to the Suez Canal. Notably, the German Hapag-Lloyd group, one of the world's largest container ship owners, announced the transfer of 42 of its ships from the Panama Canal to the Suez Canal. This shift in routes has exacerbated the Panama Canal's crisis, presenting an opportunity for the Suez Canal to benefit significantly from the situation. [10]

However, as the Panama Canal grapples with its challenges, another crisis unfolds in the Red Sea region. The Houthi rebels, in their intentional efforts, have targeted ships associated with Israel or heading to Israeli ports. Their aim is to besiege the Israeli economy and compel a cessation of the brutal aggression against the Gaza Strip. Given that 99% of Israeli imports arrive by sea, with 30% passing through the Red Sea, the Houthi strikes have a substantial impact on the Israeli economy. [11]

Yet, the consequences of these attacks extend beyond Israel. The disruption caused by the Houthi assaults on commercial ships has reverberated throughout the global trade network. The Red Sea region, serving as a crucial maritime passageway, facilitates approximately 10% of the world's gross domestic product, with around 35,000 ships traversing its waters annually. The Suez Canal, in particular, handles 12% of global trade, including 30% of container traffic, amounting to over a trillion dollars' worth of goods each year. [12]

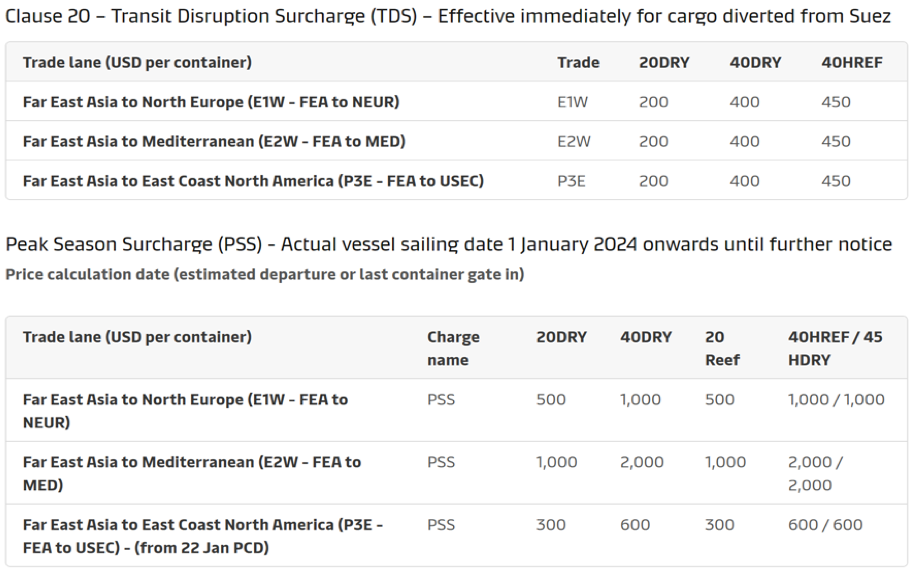

The Houthi attacks have prompted global shipping companies to suspend voyages through the Red Sea, diverting ships to the longer and costlier route around the Cape of Good Hope in southern Africa. This redirection has disrupted global supply chains, impacting the flow of goods and posing a sudden blow to the global economy in 2024. As shipping giants, including Maersk and BP, alter their routes, congestion around the Cape of Good Hope becomes evident. [13]

ESCALATION IN YEMEN: HOUTHI ATTACKS AND US RESPONSE

Amid escalating tensions in Yemen, the Houthi rebels, wielding significant control over the North of the country, have retaliated to airstrikes on their territory by launching a ballistic missile at shipping in the Red Sea. Although the missile failed to hit its intended target, the Houthis issued a stern warning, cautioning the US and its allies that they would "pay a heavy price for their aggression." [14]

In response to the Houthi actions, the United States swiftly conveyed its disinterest in engaging in a war with Yemen, mere hours after launching a military operation targeting Houthi rebel positions. The missile strikes resulted in the loss of five lives and left six individuals wounded. However, a spokesperson from the White House emphasized that President Biden's actions were solely aimed at averting any further escalation of conflict. [15]

The military operation, orchestrated by a coalition of countries, was strategically designed to dismantle Houthi military infrastructure and munitions, with specific targets identified in the Yemeni capital, Sana'a.

The joint military strikes were precipitated by nearly two months of relentless attacks by the Iran-backed Houthi movement on cargo ships in the Red Sea, causing disruption to commercial shipping and exerting profound impacts on the global economy. The Houthi rebels have justified their actions as a response to perceived western support of Israel and solidarity with the Palestinians in Gaza. [16]

As the situation in Yemen continues to evolve, the confrontations between the Houthi rebels and the US-led coalition reflect a deeply entrenched web of geopolitical tensions, with implications extending beyond the immediate region. The impact of these developments on global security and economic stability remains a critical concern, with the potential to reshape the landscape of international relations. [17]

THE PRICE OF CONFLICT: HOUTHI ATTACKS AND THE STRUGGLING YEMENI ECONOMY

The escalation in Houthi attacks ravaging maritime commerce in the Red Sea carries significant ramifications for Yemen's economy. The severe impact on shipping and trade routes has disrupted the flow of essential commodities, resulting in a surge in costs that exacerbates the already dire economic and humanitarian crisis gripping the country. [18]

The surge in shipping costs for containers traveling from China to the Port of Aden, which have more than doubled in a short span of time, places a heavy burden on Yemen's economy. The Port of Al-Hodeidah, has also experienced a significant increase in shipping costs. These soaring prices directly affect the availability and affordability of goods, further straining the already vulnerable Yemeni population. [19]

The cost of shipping 40-foot containers from China to the Port of Aden has experienced an alarming escalation, reaching unprecedented levels. In a matter of weeks, prices have surged from $3,000 on November 22, 2023, to a staggering $6,200 by December 19. This surge continued unabated, culminating in an eye-watering $11,000 by December 25. The subsequent fluctuations witnessed by January 4, 2024, saw prices hover between an astonishing $9,600 and $9,950. [20] Correspondingly, the Port of Al-Hodeidah, which is under Houthi control along the Red Sea coastline, has become entangled in the web of escalating shipping costs. Commencing at $4,950 on November 22, prices catapulted to $7,800 by December 19. The surge then reached its zenith, peaking at approximately $12,700 on December 25, before finally stabilizing at $11,550 on January 4. [21]

Related: Houthis Naval Attacks Threaten Yemenis with More Hunger

These dramatic statistics underscore the consequential impact of Houthi assaults on commercial vessels operating in the Red Sea since November 19. Notably, the Retaliation to airstrikes on Houthi territories by launching a ballistic missile at shipping in the Red Sea, has further intensified the pressing question of how these attacks contribute to the alarming surge in poverty and hunger decimating the Yemeni population. [22]

As we are reaching the season of Holy Ramadan in the upcoming months The escalating prices of food have emerged as a grave concern as a direct consequence of Houthi attacks in the Red Sea. Numerous ships are now circumventing Yemen due to the ongoing crisis, significantly impacting Yemeni merchants who rely on trade with China and other nations. The arduous challenge of shipping goods through Yemeni ports has dealt a severe blow to these merchants. Furthermore, the surge in insurance costs for ships heading towards Yemeni ports will undoubtedly exacerbate the living conditions of the people residing in Aden and Yemen at large Specially during Eid Al-Fater season which will spike the clothing prices rockets high. [23]

The Houthi attacks have prompted the creation of multinational task forces and increased military presence in the region to safeguard navigation and protect ships. The deployment of these forces and the potential for further military action in response to the attacks carry geopolitical implications that can further impact Yemen's economy and stability. [24]

THE GLOBAL ECONOMIC IMPACT OF HOUTHI ATTACKS:

As we navigate through the complexities of global trade, the recent Houthi attacks in the Red Sea have sparked a fundamental question: How can these attacks affect the global economy? To comprehend the far-reaching implications, we must first examine the intricate web of maritime routes and the economic repercussions of altering these vital pathways.

Considering a ship embarking from the bustling port of Singapore in Southeast Asia, destined for the prominent maritime hub of Rotterdam in the Netherlands. The natural route for this journey involves navigating through the Red Sea and transiting the Suez Canal, culminating in a 26-day voyage. However, if circumstances compel the ship to chart a course southward, circumnavigating the Cape of Good Hope, the journey extends to a minimum of 36 days. This additional distance translates to millions of dollars in extra costs, primarily attributed to heightened fuel consumption and disrupted supply chains. [25]

Figure 4: By the author

Figure 4: By the author

Redirecting a ship to the Cape of Good Hope instead of the Suez Canal incurs an additional million dollars in fuel costs for each round trip, alongside the logistical challenge of delayed arrivals and extended turnaround times for subsequent shipments. Consequently, this prolonged journey has contributed to a substantial surge in spot container shipping rates between Asia, Europe, and the United States. The extended travel duration has also led to a reduction in ship availability, prompting shipping lines to escalate their prices. [26]

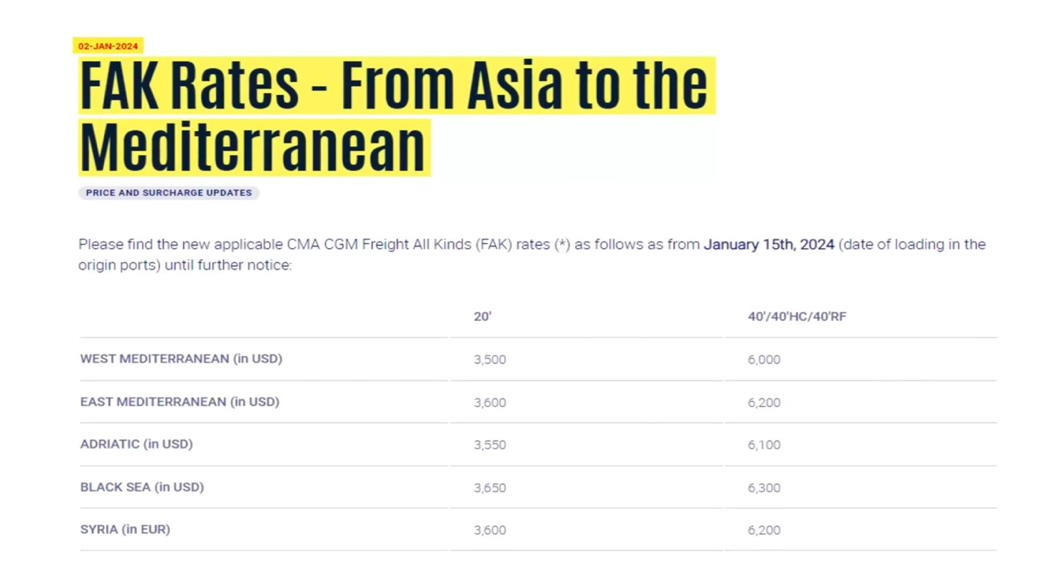

According to Freightos, a prominent platform for international shipping, the spot price for shipping goods in a 40-foot container from Asia to Northern Europe surpassed $4000 on January 3rd, marking a staggering 173% increase from mid-December. This surge is anticipated to escalate further, with major shipping companies, including the French group CMA, announcing significant price hikes for container shipping from Asia to the Mediterranean. [27]

Figure 5: (CMA CGM | FAK Rates - From Asia to the Mediterranean, 2024)

Figure 5: (CMA CGM | FAK Rates - From Asia to the Mediterranean, 2024)

The repercussions extend beyond shipping rates, as the costs of insuring ships traversing the Red Sea have surged sharply due to heightened risks in the region. Marine insurance companies in London have expanded high-risk areas within the Red Sea, resulting in a tenfold increase in the cost of insuring a single ship. This surge in costs, coupled with the amplified fuel consumption and increased container prices, is poised to elevate the prices of goods transported by sea. Consequently, retailers and manufacturers are expected to pass on these higher costs to consumers, potentially fueling a global increase in the inflation rate. [28]

Figure 6: Maersk (2024, January 17). Red Sea / Gulf of Aden situation: Vessel contingency updates. Maersk. https://www.maersk.com/news/articles/2023/12/22/red-sea-gulf-of-aden-situation

Figure 6: Maersk (2024, January 17). Red Sea / Gulf of Aden situation: Vessel contingency updates. Maersk. https://www.maersk.com/news/articles/2023/12/22/red-sea-gulf-of-aden-situation

The impact is not confined to shipping and trade alone. The disruption in energy flows, particularly concerning gas transportation by sea, poses significant concerns for Europe, which increasingly relies on sea-bound gas shipments to replace gas from Russian pipelines. As a result, it is anticipated that fuel and commodity prices heading to Europe will experience a substantial surge. This disruption has already prompted major companies, such as IKEA, to seek alternative options to ensure the provision of their products, while retail giants in the United States, including Walmart and Target, grapple with the implications of disrupted shipping routes. [29]

The situation has prompted Israeli, in collaboration with the United States and its European allies, to form an international military task force aimed at safeguarding the vital shipping lane from Houthi attacks. Despite these efforts, the attacks have persisted, prompting the United States, Britain, and other allies to launch a military operation targeting Houthi rebel positions after having issued a final warning to the Houthi group, threatening military intervention if the attacks continue. [30]

As the world grapples with the evolving situation, the implications of these events on the global economy are profound. The ongoing conflict underscores the intricate interplay between geopolitical tensions, global trade, and the delicate balance of economic stability. The ramifications of these developments are far-reaching, with the potential to reshape global trade dynamics and impact the cost of living for consumers worldwide. [31]

In conclusion, the Houthi attacks in the Red Sea have not only disrupted global shipping and trade but have also precipitated a series of complex economic challenges with implications that extend far beyond the immediate region. As the world closely monitors the unfolding events, the impact of these attacks on the global economy remains a critical concern, with the potential to shape the trajectory of international trade and economic stability in the months to come. [32]

Eng. Ahmed Salem Bahakim

Economist and energy researcher, Researcher at South24 Center for News and Studies